How to judge risk with less risk

Buying and selling risk is a highly complex activity. Firstly, one can never totally eliminate risk. If this was the case then nobody would pay a premium for it. That is why ‘risk-free’ assets only earn equal to the borrowing costs. Still, banks and insurance companies strive to mitigate, reduce, price and better manage risk than competitors.

One way to manage risk is to increase scrutiny. The logic being, the more information you can collect about your customer the better you can assess and price the risk of default or death. This works in most cases, however, it can be a double-edged sword. Increasing diligence and underwriting shrink the total addressable market. Longer onboarding journey is the biggest reason for drop-out rates and financial services have the worst track record at a whopping 84% of started applications, being abandoned. Customers hate sharing tons of personal and professional information. These long checklists and questionnaires cover topics that sometimes customers themselves are not aware of. Younger generations cannot and, most likely, will not navigate this complicated buying experience.

An equally detrimental impact takes place internally. Deploying a lot of resources for risk assessment can be costly. Disjointed legacy systems and a multitude of external sources combine to provide the assessment required to make a decision. Over the years, especially after the financial crisis, these requirements have grown exponentially while stagnant revenues and low-interest rates have squeezed profits. Something the US insurance industry was facing in 2016:

Revenues have since started increasing but the sector remains under pressure. This pressure translates into cost-cutting measures - something the financial sector is perpetually engaged in. Inevitably employees, especially in operations and risk management come under pressure. GenRe calculated that last year a full-time underwriter was assessing over 6,000 health risk applications annually, almost 24 a day, three every hour. Such demands erode morale and deteriorate the quality of outcomes.

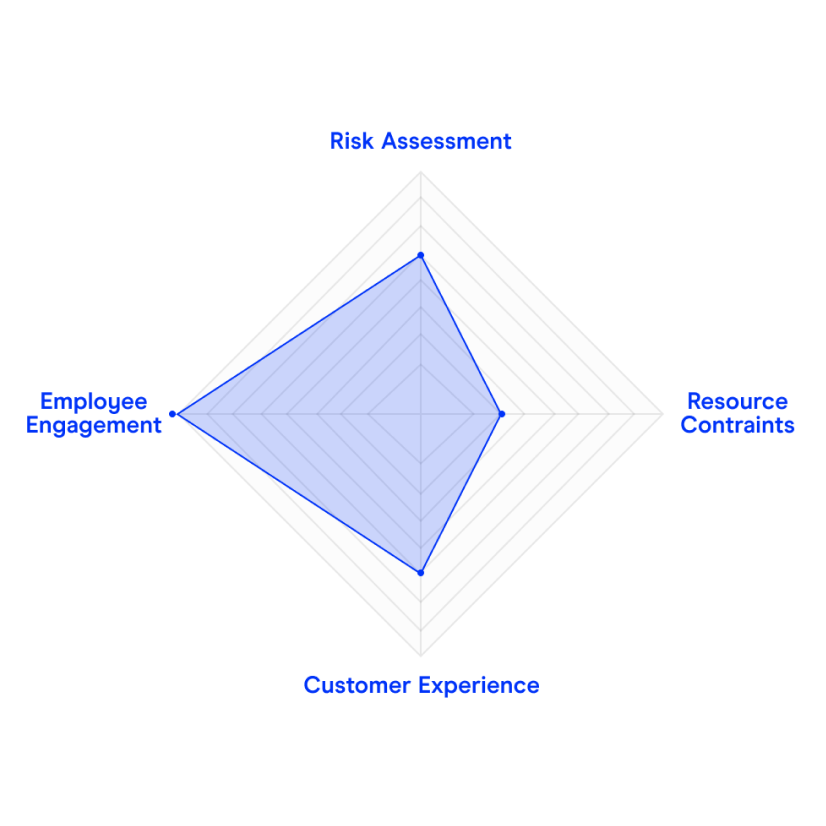

Balancing and recalibrating the trade-off between risk assessment and cost pressures with the customer experience and employee engagement remains the big zero-sum challenge

Life and health underwriting gets around this trade-off by pooling risk. Group life and health offerings cross-subsidise healthy and unhealthy individuals to manage portfolio risk. However, the lack of individual insights leads to uncompetitive pricing. An insurer faced with sub-optimal loss-ratio would be hard-pressed to increase risk assessment coverage to optimize pricing and reduce claims.

Such zero-sum challenges can only be solved with technological transformations. Just like centralised and electronic credit histories increased scrutiny while cutting down on paper and time. Most recently challenger banks leveraged troves of biometric data to streamline ‘know-your-customer’ checks to offer full banking services in minutes.

This trove of biometric data is also revolutionising health risk assessments for insurance policies and making it easier, to come back to my earlier point, to increase scrutiny without any additional effort for the applicant.

By 2022 there will be over 1 billion connected wearable devices monitoring an increasingly vast range of biometrics in real-time. Jut smartphones alone carry enough health information for a comprehensive health assessment with a level of accuracy much higher than traditional approaches employed by insurers.

Due to both the level of detail in the measure data (e.g. minutely heart-rate, activity, ECG, etc. readings) and the quick, digital API connection to given data sources, insurers have access to a quick yet incredibly accurate way of judging risk.

If you are a health or life insurer looking to utilise new digital data sources in your underwriting to increase profitability through reduced application times and increased accuracy, please reach out to Qumata via contact@qumata.com